Reliance Jio launched its services in 2016. It’s been five years. Many predictions for the telecom industry were made then. Predictions like -

The sector will now see numerous mergers and amalgamations. That’s the only way out for survival.

Only two major players will remain. Others will have to perish.

Jio will never be able to make a profit. It is too ambitious a project.

The third one of course went awry. But the other two seem to be on their way to fruition. When Jio launched its services, Indian customers had majorly four providers to choose from:

Bharti Airtel

Vodafone

Idea Cellular

newly launched Reliance Jio

In 2017 Vodafone and Idea realized that going alone was not an option anymore, given the new competition from Reliance Jio and the huge cash burn that they were making to gain market share. They joined hands to form Vodafone Idea Limited. Yet, that was of no major help as can be seen now.

Recently, the Birla group announced its intention to sell its stake to the government, and getting no response Mr. Kumar Mangalam Birla resigned from the company. Now the sector is staring at an impending duopoly in the market with VI’s debacle almost certain unless the government steps in to save competition.

What caused the downfall? Was it predictable? Here, I present an analysis -

Debt

Debt is like water. It can be life-giving if used in limited quantities and in a controlled manner. However, it can cause floods and mass destruction when goes out of control. In the same way, debt is useful only when the return from operations exceeds the cost of funding, else it can single-handedly destroy a company.

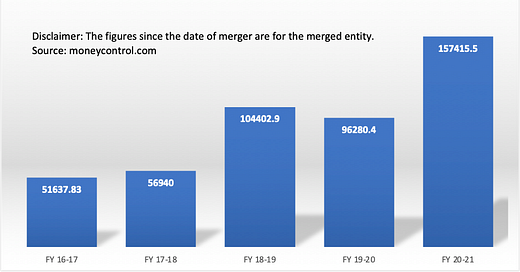

Here’s a chart of VI’s debt spiraling upwards -

The total gross debt for VIL stands at ₹1.92 lakh crores (comprising deferred spectrum payment obligations of ₹1.06 lakh crores and AGR liability of ₹ 0.62 lakh crores).

This means that VIL is in immediate need of funds. Vodafone UK has already refused to invest any further in their India operations, and Birlas have offered their stake to the government.

The company is reeling under negative net worth.

Falling subscriber base

Any business can hope for revival when it has some loyal paying customers. VIL is losing just that. Here’s a chart showing the falling subscriber base (which includes premium customers) -

While the Average Revenue Per User has shown some increase due to VIL’s recent increase in prices, it is not enough in light of the falling subscriber base.

Competition from Jio and Bharti Airtel is further killing any hope for revival.

What went wrong really? An even better question would be, what did Airtel do differently to not only survive but thrive in this new competition from Jio while VIL languished?

That leads us to a very interesting case study. Back when Jio was launched, Airtel had many services in place, in each of which it was a strong contender - including wireless telephony, broadband, and DTH. It used this ecosystem, along with its strong customer service (which Jio lacked) to create an ecosystem for its users.

While Jio was using wireless telephony along with services like Jio TV, Airtel positioned itself with Broadband and DTH at the forefront where the competition was marginal. It managed to make its mark with valuable offers (such as free OTT subscriptions to Prime and Hotstar, Wynk Music, etc.) until its customers were deep into the Airtel ecosystem.

It is further strengthening this effect with the launch of Airtel Black, which lets the customers combine all their Airtel services into one.

All this while, Airtel also made various strategic acquisitions to expand its spectrum and improvise its service including Tata Teleservices and Tata Docomo, Tikona 4G spectrum, etc.

Mr. Sunil Bharti Mittal has truly proved his business acumen in the face of one of the largest crises Airtel has faced this far. As investors, we have some lessons here -

Conglomerates or companies offering multiple products/services are positioned to survive better in the face of competition.

Retention of customers needs the creation of an ecosystem, especially for service-oriented businesses (companies like Paytm are in the process of becoming a super-app for this very reason).

Whenever there is a huge disruption in any sector, chances are high that some will prosper better than before, while others will suffer. A smart investor must look for early signs of a leader in the making.

What would you add to the above list? Tweet to us @advthinktank.

Surbhi Singhal is a Chartered Accountant and a Company Secretary; and the founder of Advance Thinktank. The company specializes in preparing custom research reports regarding investment opportunities in India, tailored to the client's needs.