#16: The old is dying and the new cannot be born.

US dollar's supremacy challenge and a new reserve currency.

The United States is the world’s biggest economic power, boasts of the largest defense expenditure, and its currency is used as a reserve by the world. These three facts, more than anything else, contribute to US’s supremacy in the world.

It has remained a world leader for a major part of the lives of all readers of this article. Whether it will continue to remain so is a big question that began to be asked during the 2008 crisis and has only gained prominence in the Ukraine crisis.

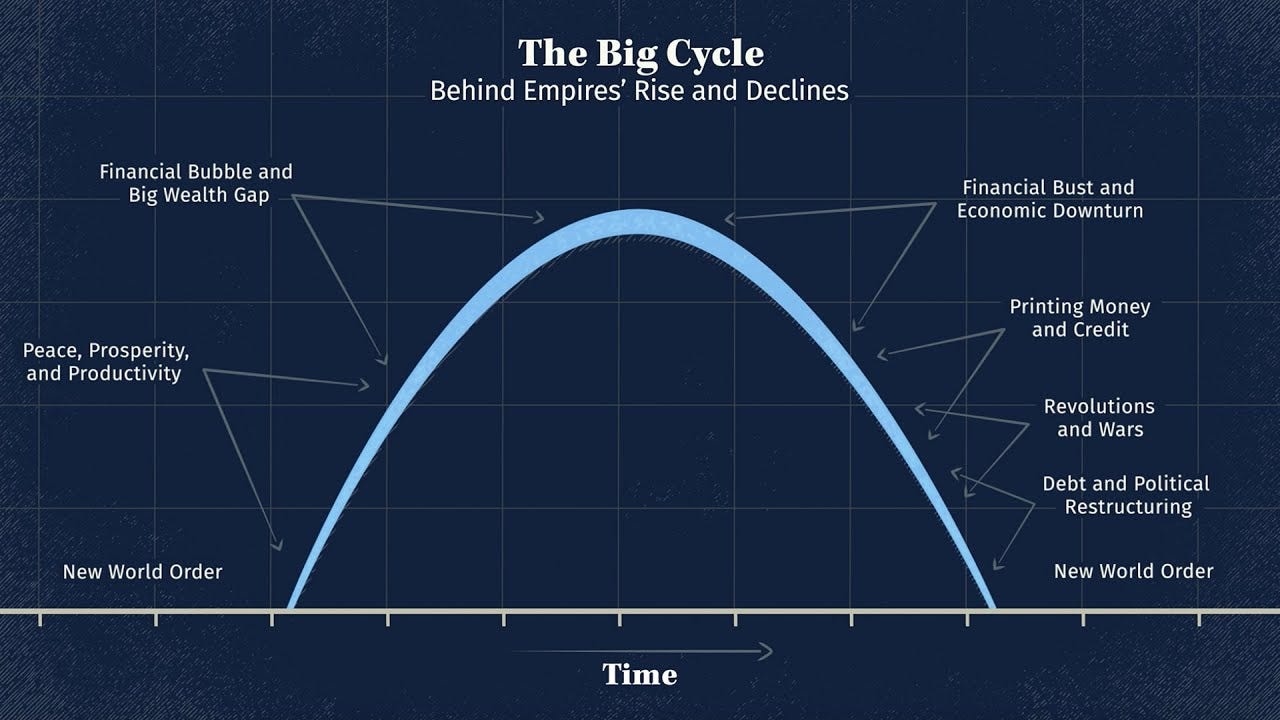

Ray Dalio, a renowned investor, and hedge fund manager in the US, argues in his book ‘The Changing World Order’ that all nations and empires are subject to big cycles. This big cycle indicates an impending decline when a nation reaches economic prosperity, and the same cycle also ensures the reverse during high recessions.

This happens due to certain reasons - people tend to become lazier with more prosperity, debt isn’t put to good use, and innovation declines. Similarly, people tend to become hard workers when poor, which in turn leads to higher innovation and more efficient use of debt and capital.

His thesis became all the more relevant as the war between Russia and Ukraine brought out. Experts began opining that the actions by USA (or the lack of it) were indicative of the declining position of the world’s greatest power.

Almost immediately began the discussion “Who will be next?”. As if the world is a kingdom and needs an immediate Emperor without whom there would be chaos and disorder.

As Russia announced its non-acceptance of USD, the world’s de facto reserve currency, social media brimmed with discussions around how the Chinese renminbi or the Indian rupee is now bound to take over.

Now, there are more aspects to such analysis than meets the naked eye. I will discuss some of them today. By the end of it, the reader should be able to appreciate the fact that there are many moving parts to what determines the reserve currency of the world.

Also, however it may hurt to note that China is far ahead of India in economic terms (especially global trade), the fact remains true. Therefore, the ensuing discussion is limited to comparison of the US Dollar and Chinese Yuan.

Every country wants to hold high levels of forex. However, such forex would mean nothing if it cannot be put to use in times good and bad. The biggest use of any foreign currency is in trade. One of the primary reasons USD became a popular reserve currency is the large share they have in world trade. They account for more than 12% of total imports and more than 8% of total exports in the world.

What about China, you may ask. China actually beats the US. They account for more than 9% of the world's imports and more than 13% of the exports.

That proves the initial hypothesis, you may say. I suggest you hold on to that thought for a little while.

Global trade is not the sole determining factor. Having proper liquid investment avenues for the currency in reserve is equally, if not more important. Here, the US wins by a huge margin.

Not only are there little/ no investment avenues in the Chinese currency, but an illiquid underdeveloped Chinese bond market further exaggerates the problem. Further, while the US is among the world’s oldest democracies, with a considerably high level of policy predictability; China is what would one call the opposite of democracy, in every aspect.

That means that the investors are more cautious with their money in whatever little investment avenues they have in China.

The third factor is the free convertibility of currency. If a currency is not freely tradeable, that makes its value unreliable and subject to wild swings. Such a currency cannot be effectively used as a store of value.

The Chinese yuan is not freely convertible on capital account. In fact, the value of the yuan is believed to be micro-managed by the country, in order to keep its exports cheap.

In comparison, the US Dollar is fully convertible. That makes it a much more reliable store of value.

For those wondering, the Indian rupee is also partially convertible. The Indian government is actively working towards full convertibility of the rupee for increased global usage.

That makes us broadly reach the conclusion that the Chinese renminbi/ yuan is not an effective exchange for the US Dollar as a reserve currency.

At this point, you might be wondering what the possible solution could be. The old is dying and the new cannot be born.

One, the old may be dying, but it will be long many years before it can be truly dead. Nothing much is going to change immediately.

Two, the world could move towards a basket of currencies. As the US Dollar becomes increasingly less relevant, each country may want to diversify their current USD reserves with the currencies of their major trading partners.

In fact, this approach could be more sustainable and practical in the long run.

What do you think? Share your thoughts. Tweet to @ca_surbhi.

Share this post with your friends by forwarding this email or the button below:

If this email was forwarded to you, subscribe through the button:

Surbhi Singhal (the author of this piece) is a Chartered Accountant and a Company Secretary; and the founder of Advance Thinktank.