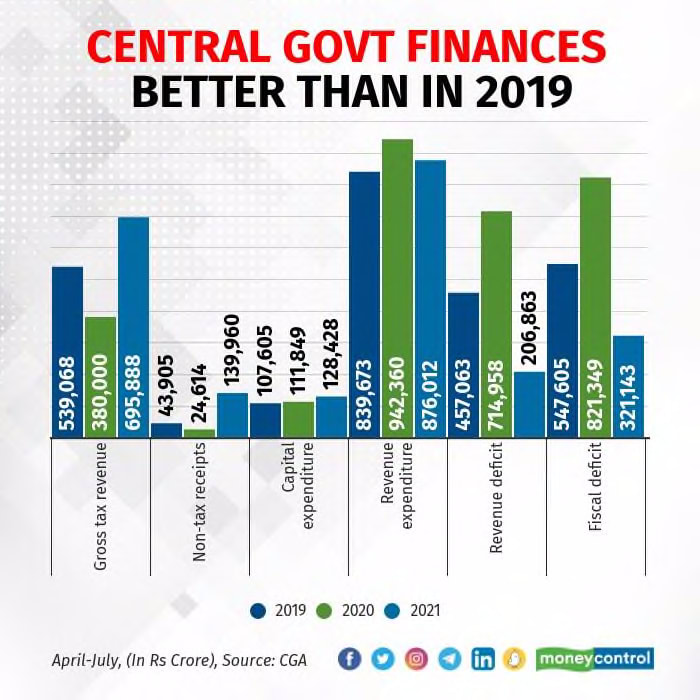

The fiscal deficit (shortfall in government’s income compared to spending) for April to July this fiscal year stands at ₹3.21 lakh crore (far below the same period last year, when it was ₹8.21 lakh crore). It is also lower than this figure 2 years ago (pre-pandemic time in 2019) when it stood at ₹5.48 lakh crores.

This is an extraordinary achievement by all accounts, especially given the ongoing pandemic and subdued business activity. So, how did the government go about achieving this?

It’s a simple formula they used - increase the income, not the expenses. This chart below by Moneycontrol explains that while the tax and non-tax receipts have increased, the revenue expenditure has been kept in check. Capital expenditure (which boosts consumption and economic activity) has increased only marginally.

What caused an increase in tax revenue when business was subdued?

A major portion of the increase in tax revenues has been contributed by Excise Duties, owing to the high duty on fuel. Excise duty collections are 83% higher than the same period in 2019.

However, it’s not the Excise Duty alone. Collections have been higher on account of Income Tax, Corporation Tax, and GST too. These increased collections are indicative of the unequal recovery post-pandemic, where large firms have grown their business manifold at the expense of MSMEs. This is also called the ‘K-shaped recovery’ (while one section of the population grows more prosperous, the other suffers).

Reading between the lines

I stated the facts above. A plain reading gives a sense of positivity and wealth. But there’s more to it (like always).

One, all the figures above are highlighting the fact that some businesses and sections of society have grown at the expense of many others. With the stock market is creating new highs every day, it is easy to forget the fact that the exchange is made up of large companies only. Many others - MSMEs, contact-based industries like travel and hospitality, the travel guides, the chaat-wallahs on the roads continue to suffer.

Two, the government spending pruning couldn’t come at a worse time. Right after a slowdown when the economy tries to speed up, it is then that the government must spend the most to boost sentiment and create demand.

Three, the threat of a looming third wave of COVID in India seems very real. It could be so that the government is preparing for such eventuality. A mistimed stimulus package right before the third wave strikes can strain the government balance sheets and put to risk any further recovery efforts.

Wear your mask, and get vaccinated. That’s all that can be done to push economic recovery right now. Let us hope the government will push in a stimulus package when the time is right.

Tweet your thoughts @advthinktank.

If this email was forwarded to you, you can subscribe.

Surbhi Singhal is a Chartered Accountant and a Company Secretary; and the founder of Advance Thinktank. The company specializes in preparing custom research reports regarding investment opportunities in India, tailored to the client's needs.