It’s been quite a year for fintech startups. A record eight companies became unicorns. That includes Digit, Pine Labs, BharatPe, Cred, OfBusiness, Zeta, Groww, and CoinDCX. Another three are IPO-bound - Paytm, PolicyBazaar, and Mobikwik. According to some recent reports, Paytm will be eyeing a valuation of more than $ 25 billion for the IPO 💸.

While the fintech space in India is at this crucial juncture, right on the verge of taking off, it would bode us well to understand how these companies operate and how they make revenues (or hope to make revenues). I will not limit this discussion to any one company, though Paytm will lead the discussion (since it is bringing the largest IPO in Indian stock market history).

Also, I will make this discussion in a reverse fashion. That means that I will first discuss how the companies ultimately hope to make revenue and then will go on to discuss what they are doing today to be able to get there. Along the way, I will also discuss the necessary pivots that they found worth taking in order to stay relevant and stay afloat.

Each and every business in finance out there makes money in either or all of these three ways -

Commission

Interest

Fees

- that includes the traditional banks, the finance companies, the local moneylender, and also the shiny fintech companies.

The traditional banks make use of all three.

Then there are payments banks. They make their revenues predominantly through the commissions on payments facilitated by them. That is also what Paytm did. And that was its initial revenue model. However, the revenues were wafer-thin and far from profitable. And then, UPI came along. There are no intermediary fees in payments through UPI.

Faced with difficulty, Paytm did what all intelligent startups do.

They began finding ways that would make users stick to their platform - both the merchants and the consumers. Ways were not only meant for increasing the app stickiness, but also making greater use of the Paytm payment gateway. They introduced the Paytm Mall and their own app store. They facilitated online ticket booking - for everything ranging from comedy shows to air travel.

They offered value-added services to merchants such as account management. Soon, Paytm introduced Paytm Money - an investment platform that facilitates investing in IPOs, MFs, equities, etc. (it is still in the nascent stage).

Basically, Paytm has set its eyes on becoming a super app. But, that’s with one basic offering - the payments gateway. That’s for now. Once it has a sufficient number of users on its platform, and sufficient data with regard to the financial credibility of those users and their spending habits, it would introduce two new revenue streams -

Lending to merchants

Advertisements by sellers on the other goods/services offered through the super app.

That’s a gold mine, to be honest. For these reasons -

Traditionally, NPAs (or bad debts) have been a huge headache for the entire lending business in any economy. So much so that the lending business has to be controlled by the government (through the RBI) in order that the financial system does not fall apart. Knowing in advance whether a customer would pay back a loan is nearly impossible. But not with big data and artificial intelligence. Companies like Paytm will have enough data (at least they hope to) to determine with reasonable certainty the paying capacity of a prospective borrower.

To top that off, since the entire process will be tech-enabled, there would be a minimum human intervention which would translate to lower staffing costs.

Coming to advertisements, we already know of two major giants who have had revenue from advertisements turn things around for them in ways no one on earth had ever imagined - yes, they are Google and Facebook. So really, the possibilities are endless on this front too.

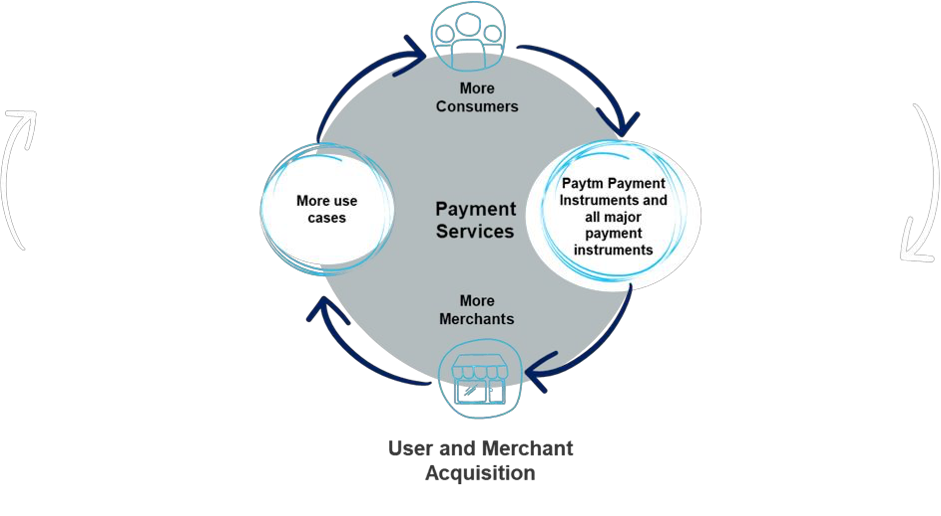

Here are some flowcharts as presented by Paytm itself in its SEBI filing for the IPO, that explain the business model as envisioned by the company itself -

Step 1:

Step 2:

Step 3:

Similar is the story of CRED. One might say that the services offered by Paytm and CRED are similar in no manner, other than the fact that they are both fintech companies. I differ in my opinion though. Once you get beneath all the shine, CRED aims at lending too.

In fact, that is the primary reason it has been eyeing all the premium credit card using people in India. It aims at understanding how timely they pay their credit card dues, what is it that they like to spend the most on (remember CRED store?), and more stuff like that. In fact, the recently launched service CRED Mint is a step towards this lending space.

PolicyBazaar and PaisaBazaar earn their revenues in commission and fees too, through the sale of financial products offered by insurance companies and finance companies. All this while, they too collect data that could be of greater use in the future.

While all this may look very profitable in the long-term, as investors we must remember to look at the risks as well. And even more importantly, the price we pay for ownership.

Perhaps I will discuss that aspect in another newsletter. Let me know in the comments.

Tweet your thoughts to us @advthinktank.

And do not forget to share this post (we know you loved it!). An increasing number of subscribers drives us for more and better content. If this email was forwarded to you, you can subscribe.

Surbhi Singhal is a Chartered Accountant and a Company Secretary; and the founder of Advance Thinktank. The company specializes in preparing custom research reports regarding investment opportunities in India, tailored to the client's needs.